After more than a year and 2 million sales, Alan Wake 2 is finally turning a profit for Remedy

Alan's weird misadventure in Bright Falls sold well, but cost a hell of a lot to make.

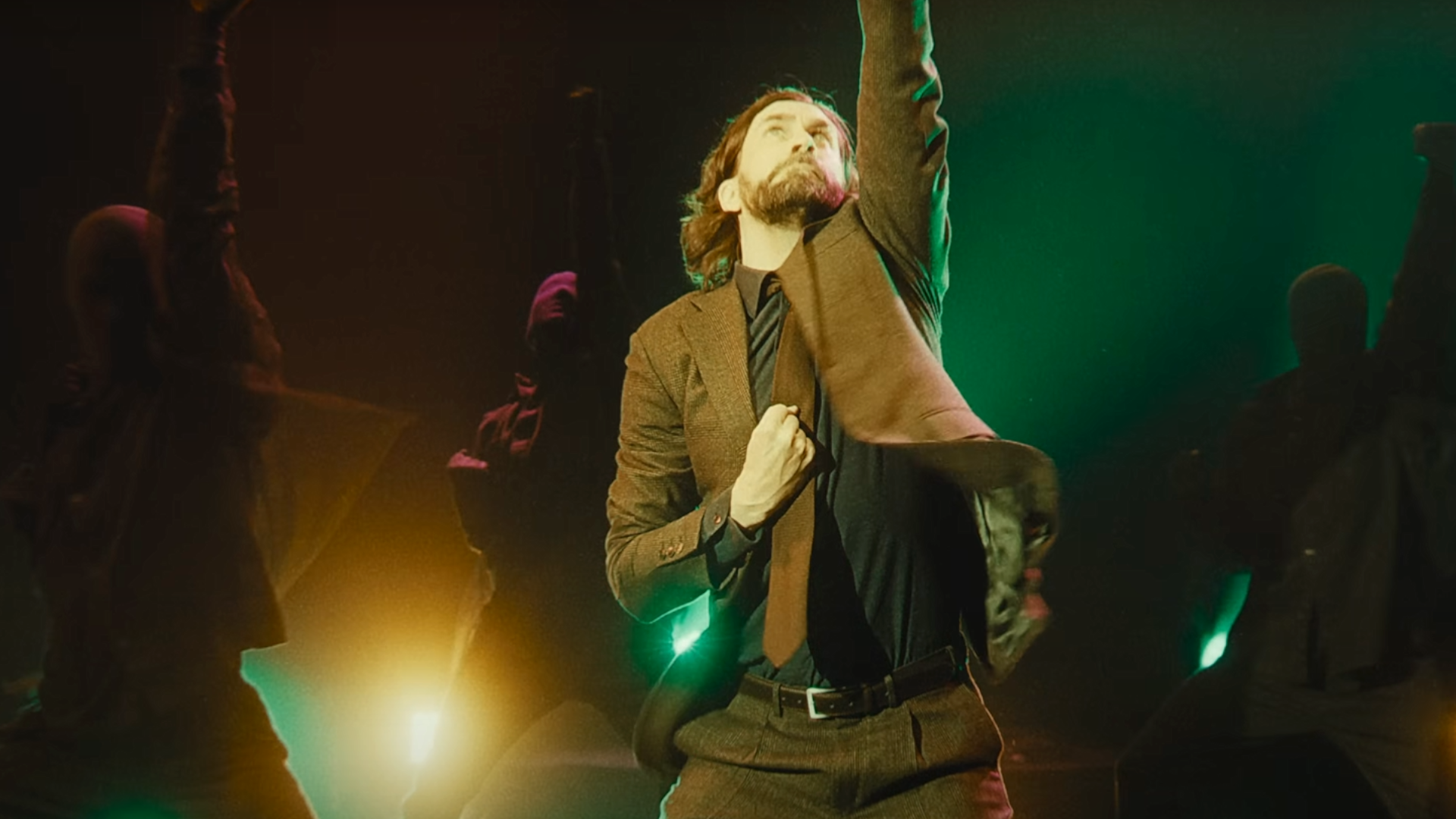

Alan Wake 2, Remedy's gorgeous oddity, is finally making the developer some cash, over a year after its launch. In a financial report published today, the Finnish studio revealed that sales of the sequel had now surpassed two million units, and that "the game started to accrue royalties".

It's taken a while—Alan Wake 2 launched in October 2023, and only started turning a profit at the end of 2024, according to the financial report. With a huge development and marketing (reportedly €70 million/$73 million), there was a lot to recoup before it could start earning Remedy some cash. And while it was Remedy's fastest-selling game, and two million sales in just over a year isn't to be sniffed at, Alan Wake isn't the kinda heavy-hitter in the horror genre that, say, Silent Hill is. Bloober's Silent Hill 2 remake, for instance, hit that same 2 million sales milestone in January, only a few months after launch.

Remedy hasn't exactly been struggling while it's been waiting for Alan to make some money, though. In February last year, it bought the rights to Control from publisher 505 Games in a €17 million/$17.7 million deal. Then, in August, it announced it would be self-publishing Control 2, with assistance from Annapurna Pictures.

Annapurna is financing 50% of the game's development budget, and it got the rights to develop Control and Alan Wake TV shows and films. Soon after this announcement, Annapurna Interactive, the videogame division of the company, imploded, with all staff quitting. This, however, apparently doesn't affect the deal with Remedy, since Annapurna Pictures was not affected by the collapse of the videogame team. Still, it's probably not a positive thing.

In September, Remedy and Tencent also entered into a $17 million loan agreement which could eventually be converted into Remedy shares after three years, netting the Chinese conglomerate an even greater stake in the company. It already controls 14% of Remedy, and these shares would amount to around 5.8% of Remedy. The deal was up for discussion in Remedy's Extraordinary General Meeting in October, where shareholders approved the loan.

Remedy had previously worked with Tencent on Project Kestral (previously codenamed Vanguard), a free-to-play co-op live service affair. It was officially cancelled last year, and it seems like Remedy took a bit of a hit from that one. While its operating profit had improved by €11.4 million in the fourth quarter of 2024 (which puts it at -€1.4 million) it lost €7.2 million in value the previous year due to Kestral.

Things are presumably looking up, now, though. It's got that Tencent cash, Alan's bringing in some money at last, and it's got a few projects on the go, including Control 2. In October, it announced co-op FPS Control spin-off FBC: Firebreak (which had previously been teased under the codename Condor) and the Max Payne 1 and 2 remakes, which are "making steady progress in full production", according to the financial report.

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Fraser is the UK online editor and has actually met The Internet in person. With over a decade of experience, he's been around the block a few times, serving as a freelancer, news editor and prolific reviewer. Strategy games have been a 30-year-long obsession, from tiny RTSs to sprawling political sims, and he never turns down the chance to rave about Total War or Crusader Kings. He's also been known to set up shop in the latest MMO and likes to wind down with an endlessly deep, systemic RPG. These days, when he's not editing, he can usually be found writing features that are 1,000 words too long or talking about his dog.