Even without price gouging, most Nvidia graphics cards cost more now than in 2016

These charts show when cryptocurrency caused prices to spike, and where cards began costing more instead of less.

The boom in cryptocurrency prices and mining has dramatically affected recent graphics card prices. It's gotten so bad, that in the past week we've written about how it's a terrible time to buy a graphics card, and why it's currently a better deal to buy a pre-built PC. Even Nvidia has chimed in, suggesting retailers sell to gamers over cryptocurrency miners. But as we've looked a bit deeper into the price history of Nvidia's 10-series graphics cards, it's clear that the current astronomical prices are due to extremely inflated third-party sellers, as major retailers are completely sold out of stock.

Below we've compiled an overview of the unusual price history of the GTX 1050, 1060, 1070, and 1080 over their lifetimes on Amazon using CamelCamelCamel. At first, these cards follow a familiar trajectory, seeing occasional sales after release. But starting in mid-2017, a boom in Ethereum mining sent those prices creeping back up, and they haven't fully come back down since.

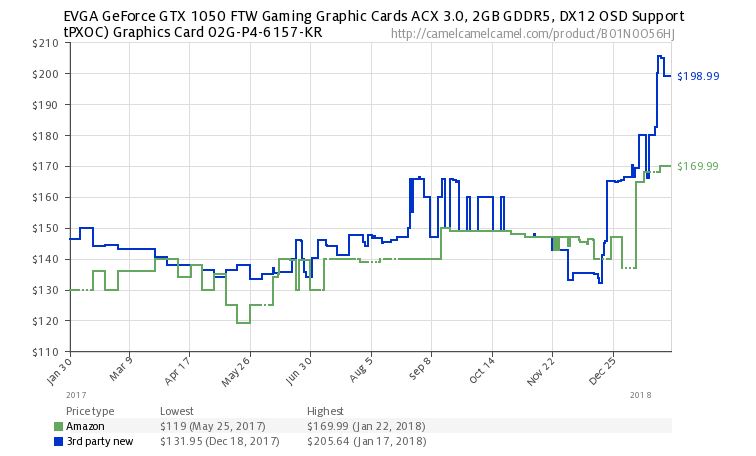

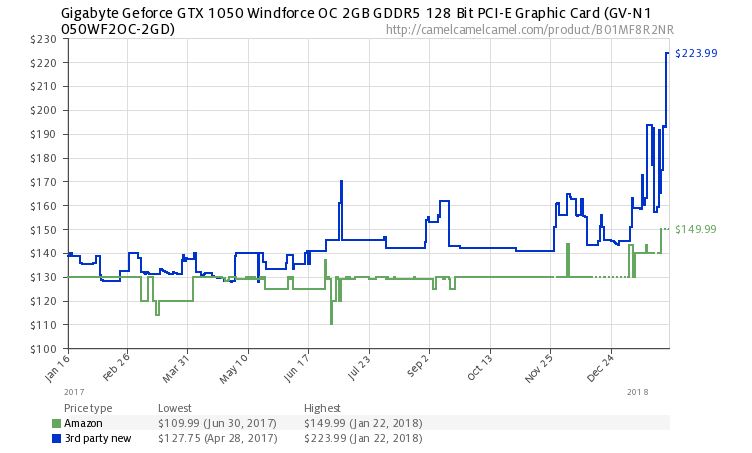

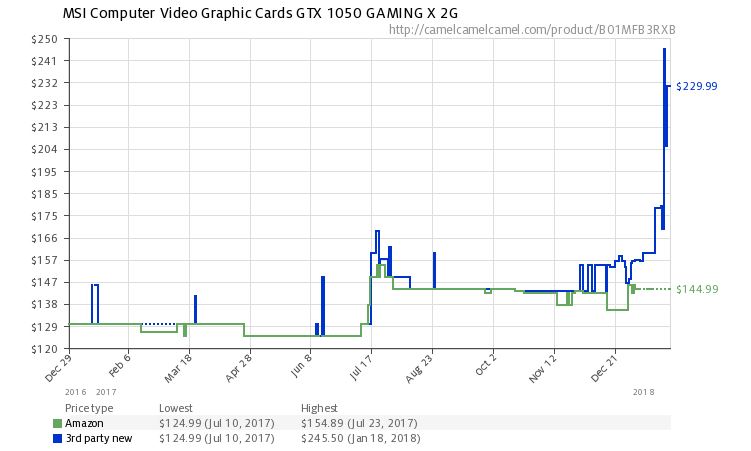

GTX 1050

In February 2017, EVGA sold this card directly on its website for $140, slightly more than it cost on Amazon. Today, it's listed on the website for $170 (and is out of stock). On the green line (Amazon) you can see a brief window where the card was out of stock in the summer of 2017 as Ethereum mining was especially popular. It's currently out of stock on Amazon, but is still set at that $140 price.

The Gigabyte 1050 Windforce launched with a $130 MSRP, which has since risen on Amazon to a base price of $150. Third-party sellers, meanwhile, have raised the price even higher than the EVGA card above, to more than $220. Overall, its Amazon price was more consistent, staying at $130 with a few minor spikes, until January of this year, when the crypto boom again hit graphics cards hard.

Third-party sellers took this MSI card's price even higher, and you can see how the Amazon price jumped from $130 to $150 in the summer of 2017, where it's mostly remained since.

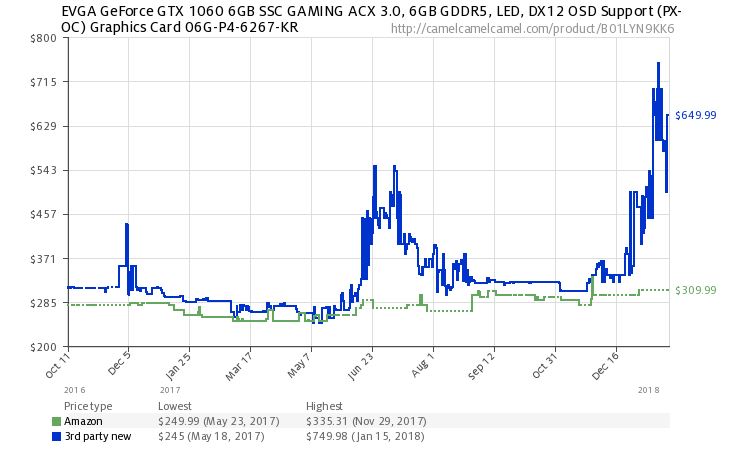

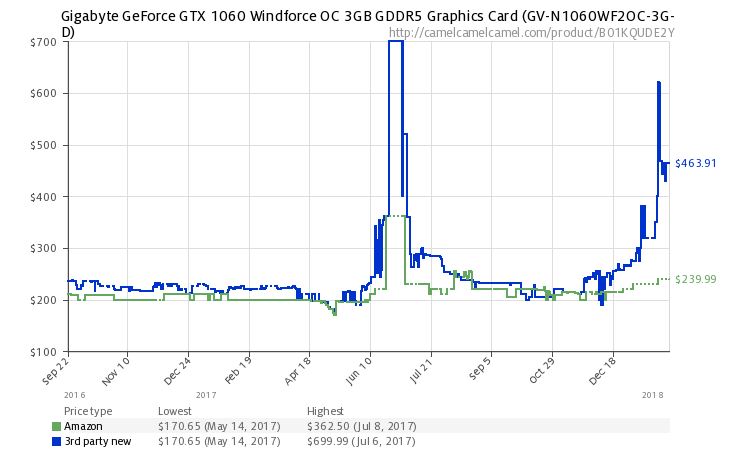

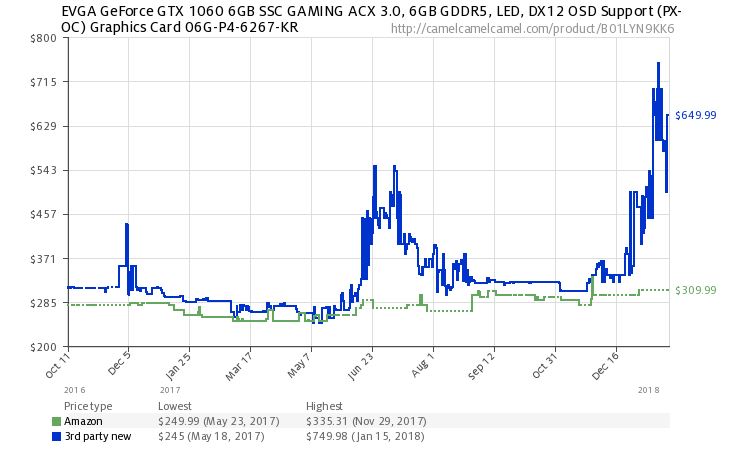

GTX 1060

The longer lifetime and erratic third-party pricing makes this spreadsheet tough to read. The EVGA 1060 3GB Gaming currently costs $240 on EVGA's website. In August 2016, when it first became available, it was $200. Third-party pricing peaked at $562 this January, 17 months after the card was first on sale.

One of the most dramatic price increases of last summer's mining boom. This 3GB 1060 card from Gigabyte, which released at $200, cost over $700 from third-party sellers for a brief window. It again came close to hitting that high this January, and currently sells for more than double its MSRP.

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

The 6GB models of the 1060 have been hit equally hard. EVGA currently has this card listed on its website for $310 (though it's sold out, like the rest). When it first appeared in September 2016, it was listed at $280. Overall that's a small price increase, but after more than a year, we'd expect the price to drop, were it not for the crypto craziness.

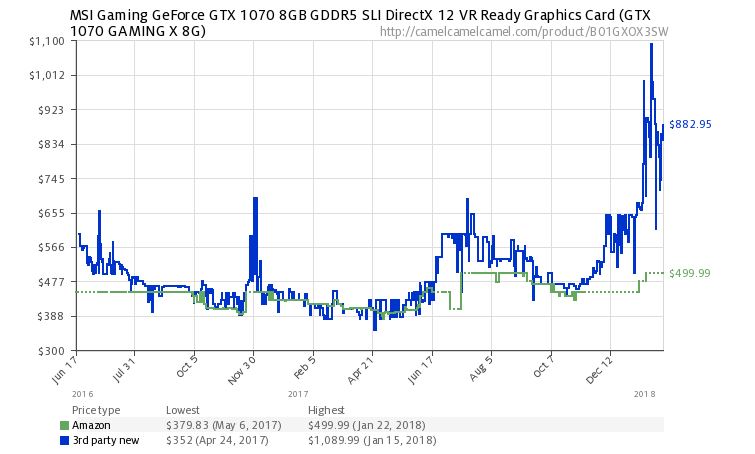

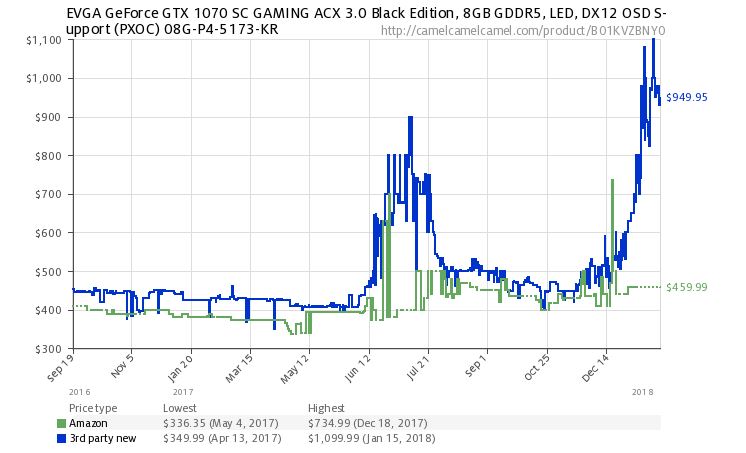

GTX 1070

Compared to the lower-end cards, you can see how demand and shortages affected third-party prices when the 1070 first became available in June 2016. Through last summer, it was less affected by the mining craze, and actually dropped in price briefly, before rising to a price higher than its MSRP at $500. It's been out of stock most of the fall, and third-parties are selling for nearly double the price.

EVGA's 1070 SC has seen some extreme price increases even sold via Amazon itself, and much higher demand and prices on the third-party side, topping out at close to $1000. For that price, you're not far off from Nvidia's extreme high-end Titan Xp card!

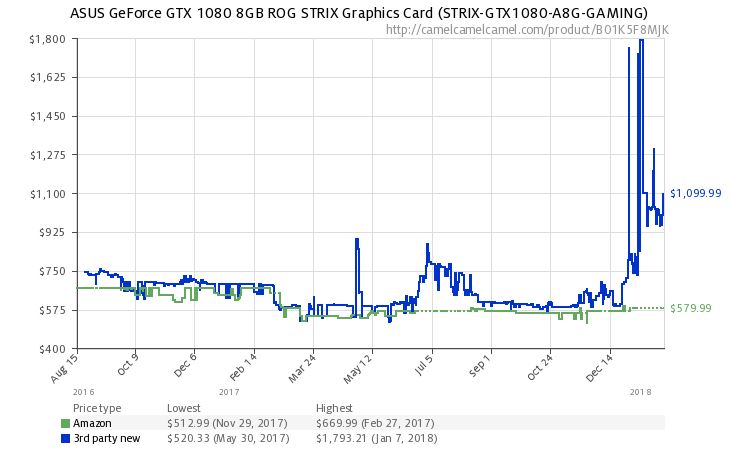

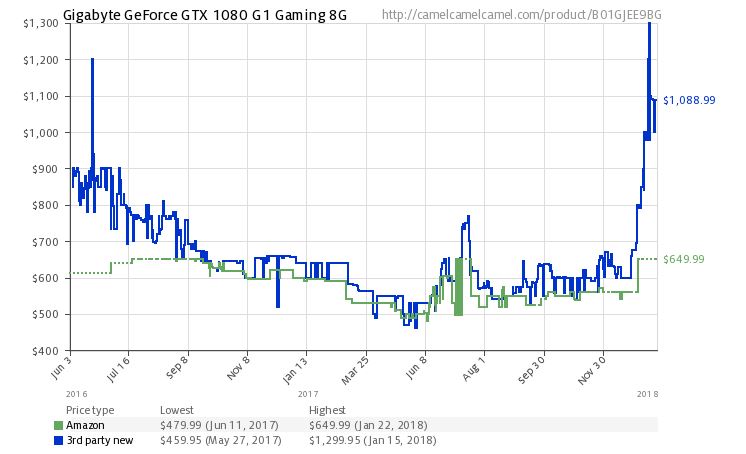

GTX 1080

The ROG Strix 1080 started at $670 on Amazon, with several price drops in the fall of 2016 taking it down to $610-$640. The price continued to fall, as you'd expect, but has now settled at $580, a more expensive price than it's regularly had since last summer. The third-party price, meanwhile, is through the roof.

The Gigabyte G1 Gaming is actually selling for more than it did at launch, putting it in line with some of the lower-end cards above. Cryptocurrency mining has obviously affected its price significantly this winter and the summer of 2017. Third-party pricing now exceeds the costs for the card when it was first available (and scarce, thanks to high demand) in summer 2016.

What's next?

Short answer: we don't know. For the sake of an easy comparison, I stuck with Nvidia's 10-series cards, but they're not the only ones affected by the crypto craze. AMD's cards have been similarly overpriced and out of stock. Cryptocurrency prices have taken a major beating in January, making it plausible that demand for new cards will cool off soon. But they may not: Bitcoin, Ethereum and all the rest are rising and falling dramatically.

Currently, demand has these cards out of stock or sold above MSRP nearly everywhere. We can only speculate about how many graphics cards Nvidia and AMD are producing, whether there's capacity to increase production, and if that increase would even make a significant difference.

Long-term, there are even more concerns. It's reasonable to assume that the fabrication facilities that are making both AMD and Nvidia GPUs are running at a high capacity. When a company is able to sell more than every processor it can produce, the impetus to create something that's newer, better, faster, and cheaper obviously drops off.

We know both AMD and Nvidia have new GPU architectures in the works, Volta from Nvidia and Vega/Navi from AMD. Nvidia already has some Volta GPUs in production, but these are the GV100 chips going into Tesla V100 (a $15,000 part, roughly) and the Titan V (a mere $3,000). The remaining Volta chips destined for GeForce cards will likely omit the FP64 and Tensor Core elements, among other tweaks, but ramping up production of the new chips will be slower if the available capacity at manufacturer TSMC is already in use.

A spring or early summer launch for Volta seemed likely a few months ago, but with the massive spike in graphics card demand, don't be surprised if things get pushed back. AMD already partially blamed the late launch of its Vega parts on cryptocurrency miners last year, and yet Vega cards have never really come close to hitting their original $399/$499 street price targets. AMD hinted at a 7nm Vega, or potentially Navi, arriving this year, but we wouldn't count on seeing such parts in any meaningful volume.

In other words, not only is cryptocurrency mining making it difficult to buy graphics cards right now, but it could be delaying faster graphics cards from entering the market in the future. Have some salt in your wounds.

Wes has been covering games and hardware for more than 10 years, first at tech sites like The Wirecutter and Tested before joining the PC Gamer team in 2014. Wes plays a little bit of everything, but he'll always jump at the chance to cover emulation and Japanese games.

When he's not obsessively optimizing and re-optimizing a tangle of conveyor belts in Satisfactory (it's really becoming a problem), he's probably playing a 20-year-old Final Fantasy or some opaque ASCII roguelike. With a focus on writing and editing features, he seeks out personal stories and in-depth histories from the corners of PC gaming and its niche communities. 50% pizza by volume (deep dish, to be specific).