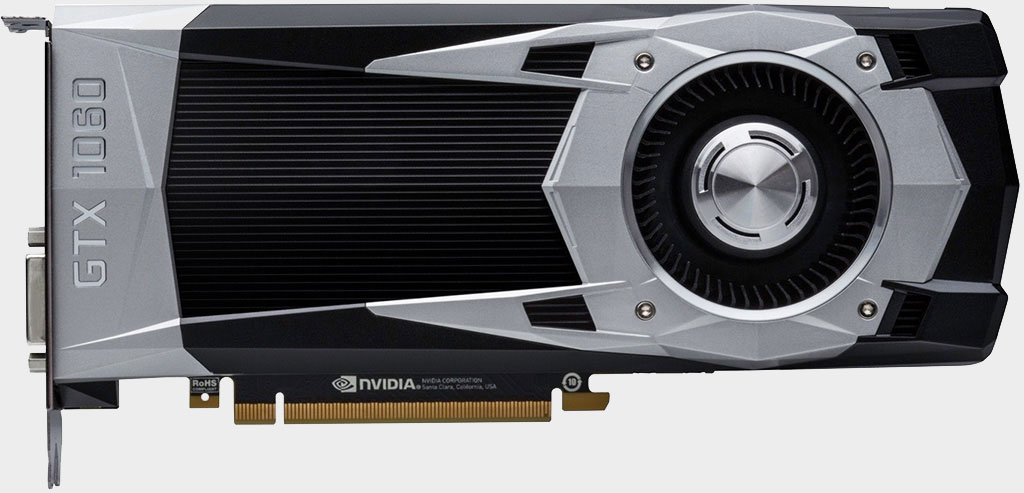

Crypto-mining crash leaves Nvidia with 'excess' inventory of Pascal cards

Nvidia saw a sequential decline in gaming revenue, but expects things to pick back up.

Nvidia's share price is getting hammered right now, dropping more than 18 percent a day after the company announced its third quarter earnings report. Part of the reason is because Nvidia had trouble clearing out its stockpile of previous generation Pascal graphics cards.

"Gaming revenue was short of our expectations, and our fourth quarter outlook is impacted by excess channel inventory of midrange Pascal products," Nvidia said.

Nvidia also noted a 23 percent reduction in OEM and IP revenue "due to the absence of crypto-currency mining."

Life will go on for Nvidia, but like ripping off a Band-Aid, it is feeling some temporary pain from the GPU market bottoming out in the cryptocurrency sector. It's less profitable to mine some of the more popular cryptocurrencies, and for the most part, the segment has shifted from GPUs to specialized ASIC hardware. This created what Nvidia referred to as a "sharp fall-off in crypto-currency mining demand."

While not stated, Nvidia might have also been impacted by its GeForce RTX launch, and specifically by users delaying purchases of graphics cards in anticipation of the launch. It will be interesting to see how things shake out in the current quarter, with the GeForce RTX line carrying a pricing premium (compared to Pascal) as Nvidia pushes the benefits of real-time ray tracing and other capabilities inherent in the underling Turing architecture powering the new cards.

For now, however, Nvidia must weather the storm of uncertainty surrounding its third quarter performance. According to MarketWatch, Nvidia is on track to see its biggest one-day drop in stock price in a decade.

"The crypto hangover lasted longer than we expected and we were surprised by that, but it will pass," Nvidia CEO Jensen Huang told MarketWatch.

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Despite the sequential drop in GPU dollars and ongoing "crypto hangover," Nvidia is still in an overall healthy spot. It generated $3.18 billion in total revenue for the quarter, up 21 percent from the same quarter a year ago, and is making gains in other areas such as AI and servers.

"Our near-term results reflect excess channel inventory post the crypto-currency boom, which will be corrected. Our market position and growth opportunities are stronger than ever. During the quarter, we launched new platforms to extend our architecture into new growth markets—RAPIDS for machine learning, RTX Server for film rendering, and the T4 Cloud GPU for hyperscale and cloud," Huang said.

Now that the cryptocurrency craze is in the rear view mirror (as it relates to consumer GPUs), it will be up to the new GeForce RTX series to run with the baton, passed forward by Pascal. Part of how that plays out will depend on the ability of game developers to release games with real-time ray tracing and DLSS support, the two most touted features of RTX. We're finally starting to see that, with Battlefield 5 gaining ray tracing support ahead of the standard edition's November 20 launch.

Related to that, Jarred had a chance to test the performance impact of enabling ray tracing (DXR) in Battlefield 5. In short, the RTX cards performed better than some might have expected, but took a "big hit" nonetheless.

Finally, Nvidia will have to contend with a new Polaris card from AMD in the midrange market, the just-launched Radeon RX 590.

Paul has been playing PC games and raking his knuckles on computer hardware since the Commodore 64. He does not have any tattoos, but thinks it would be cool to get one that reads LOAD"*",8,1. In his off time, he rides motorcycles and wrestles alligators (only one of those is true).