Crypto lenders are suffering as bitcoin miners are unable to pay back gigantic loans

As miners fail to pay back loans, crypto lenders are stuck with a bunch of mining rigs as collateral.

Things don't appear to be getting better for the cryptocurrency scene following the collapse of FTX. According to a report from Bloomberg, bitcoin mining companies are unable to pay back millions of dollars in loans, leaving their lenders stuck with thousands of mining rigs.

Ethan Vera, COO of Luxor Technologies, told Bloomberg that miners ended up "dictating a lot of the loan terms" as crypto mining boomed, and they offered the mining rigs they bought with the loans as collateral. So, if they couldn't repay the loans, they simply gave up the machines. Machines, by the way, whose value dropped at least 85% from just last month, according to the reporting. Ouch.

At its height, the crypto lending industry Bloomberg estimates that "as much as $4 billion" worth of mining equipment has been financed. As profits soared as the price of Bitcoin went up, and more loans were issued, and as Matthew Kimmell, an analyst at CoinShares, put it to Bloomberg, “There hasn’t necessarily been the best due diligence on whether a miner was credit-worthy or not."

One of the biggest lenders, the publicly traded NYDIG, stands to lose hundreds of millions of dollars as multiple borrowers, such as Iris Energy, who secured a $108 million loan, are expected to default. The bankrupt BlockFi owes the firm $54 million. Another borrower, Stronghold Digital Mining, returned "around 26,200 mining rigs" in August, Bloomberg says to get rid of its $67 million NYDIG debt.

Crypto-mining service firm, Luxor Technologies, told Bloomberg that private companies count for "75% of the computing power for the entire Bitcoin network." And as private companies aren't obligated to disclose any losses to the public, even more defaults are expected to come.

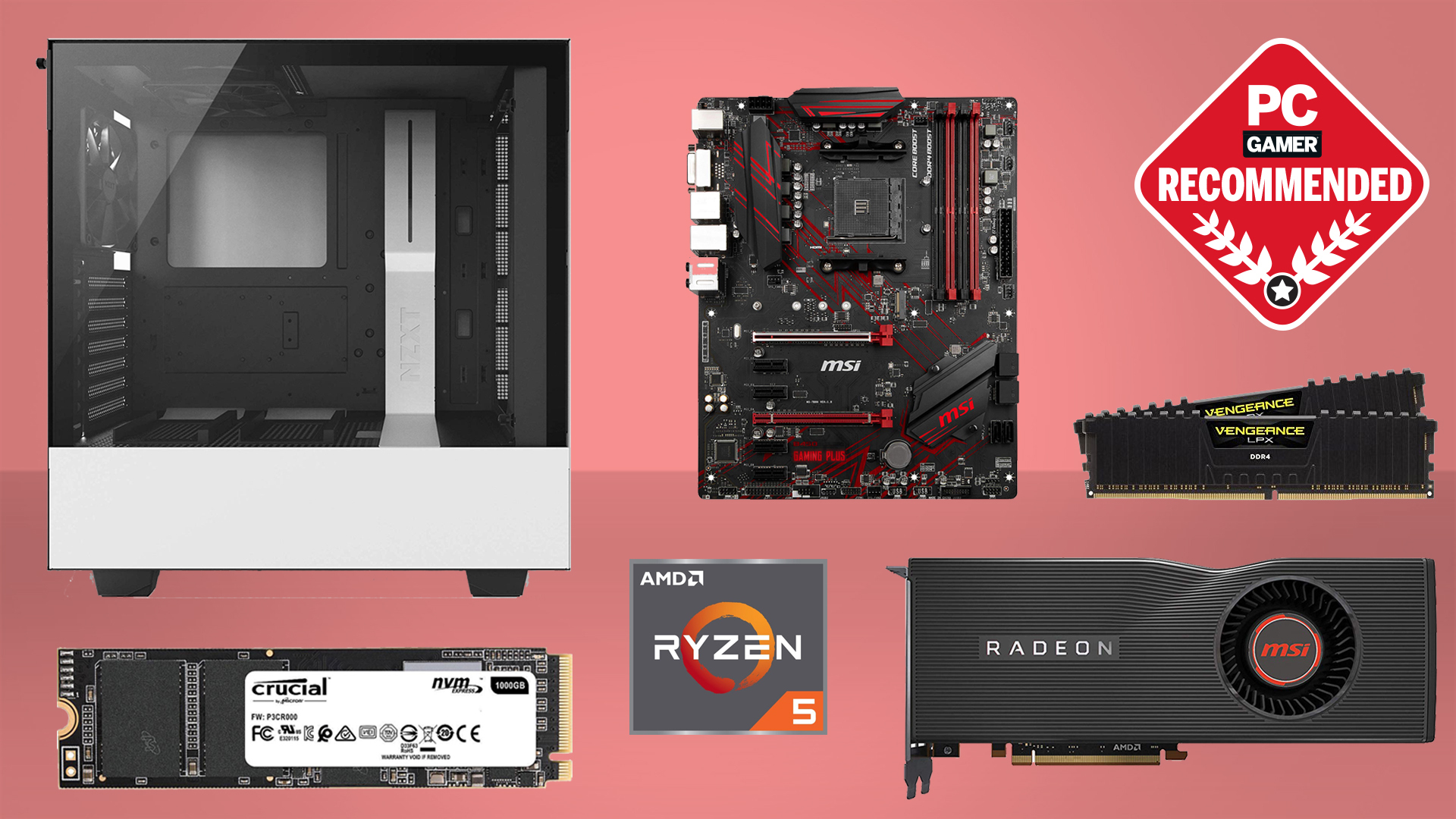

Best CPU for gaming: The top chips from Intel and AMD

Best gaming motherboard: The right boards

Best graphics card: Your perfect pixel-pusher awaits

Best SSD for gaming: Get into the game ahead of the rest

The value of bitcoin has been driven down by two recent incidents: The drama at FTX, and its rival currency, Ethereum, switching over to proof-of-stake, ending large-scale GPU mining in recent months. It's down 80% from November 2021.

Ethan Vera, COO of Luxor Technologies, told Bloomberg that for a lot of miners, it's more economical just to step away from these deals than make good with the lenders because they're "focused on how to survive the next six months rather than if they need the lender for the next five years.”

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

Jorge is a hardware writer from the enchanted lands of New Jersey. When he's not filling the office with the smell of Pop-Tarts, he's reviewing all sorts of gaming hardware, from laptops with the latest mobile GPUs to gaming chairs with built-in back massagers. He's been covering games and tech for over ten years and has written for Dualshockers, WCCFtech, Tom's Guide, and a bunch of other places on the world wide web.