Could Tether be the catalyst of a crypto apocalypse?

Situation normal. For now at least.

The cryptocurrency market has shown that it isn’t immune to wider economic issues. High cap coins including Bitcoin and Ethereum have been on a downward trend over recent weeks. But the wider economy and inflation pressure is far from the only factor influencing crypto right now. The collapse of the Terra stablecoin (UST) last week sent waves of panic through the market, with some commentators wondering if the collapse was a ‘Lehman Brothers’ moment for crypto.

But UST is just one of many stablecoins. By far the largest is Tether, or USDT. It currently sits in third place in terms of total market cap, behind Bitcoin and Ethereum. The total market cap of USDT dropped from around $83 billion on May 11 to under $75 billion as of May, according to Coingecko. This drop is reportedly due to a series of redemptions, which were redeemed for the full one US dollar value.

Tether Operations Limited, the company behind USDT, sought to reassure investors worried about the possibility of another de-pegging and bank run, which is what happened with UST the week before. The company stated on its blog that “Since May 11, Tether successfully processed $7 billion of USDT redemptions for verified individuals. Every redemption request which was submitted was redeemed in full."

Tether has faced criticism due to its lack of transparency on exactly what it's reserves are, and how much they’re actually worth. The recent Tether redemptions have served as something of a stress test. Despite some fluctuations during peak trading last week, the 1:1 dollar peg remains intact.

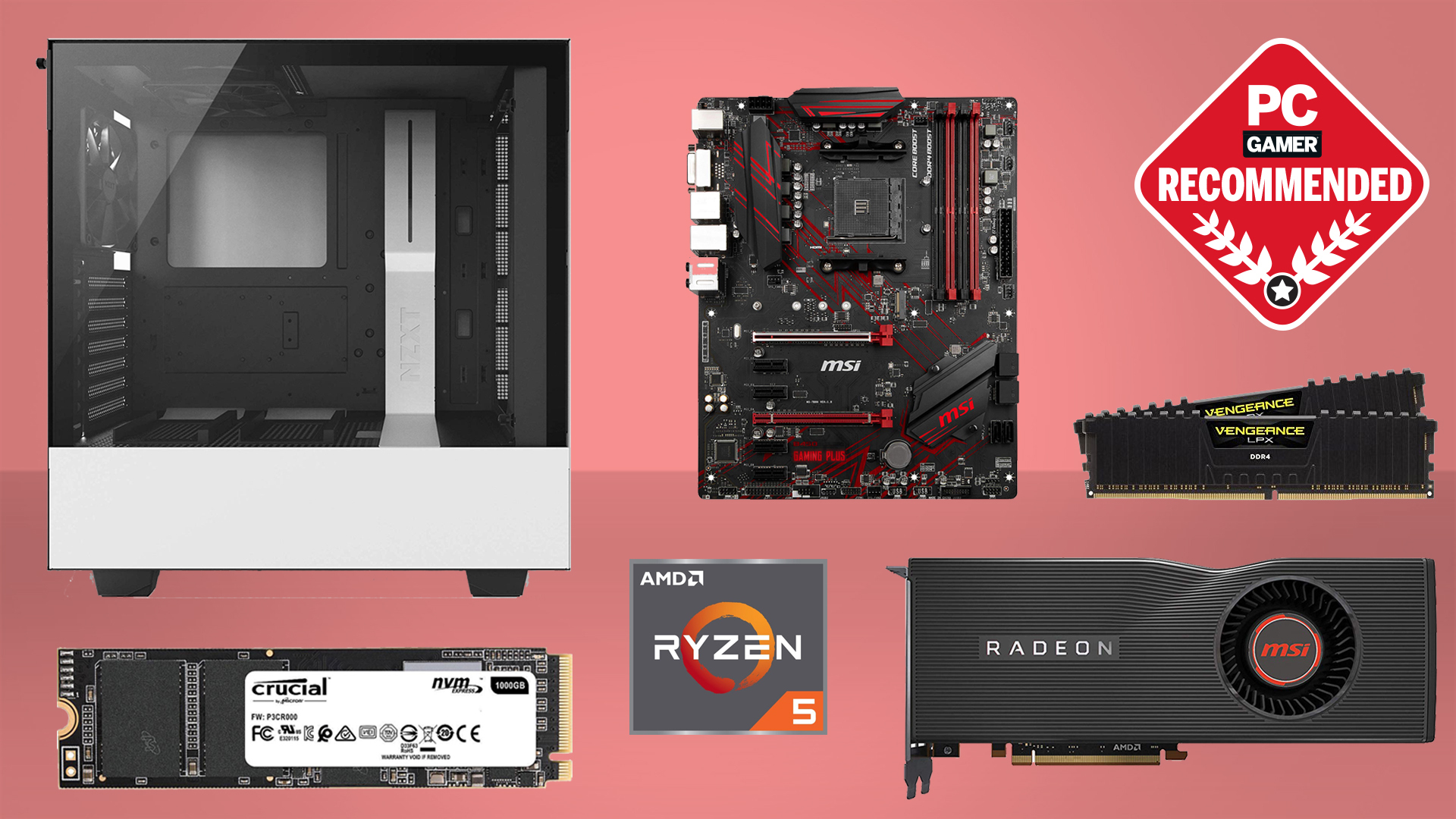

Best CPU for gaming: The top chips from Intel and AMD

Best gaming motherboard: The right boards

Best graphics card: Your perfect pixel-pusher awaits

Best SSD for gaming: Get into the game ahead of the rest

It’s important to note that USDT and UST are fundamentally different from one another. UST relied on algorithms to maintain its peg, tying it with another token called Luna. During the crash, the value of Luna went from over $80 to essentially nothing, meaning the $1 peg of UST could not be maintained. USDT on the other hand is supposedly backed by fiat and other asset reserves.

Despite Tether maintaining its value for now, questions about its level of transparency remain. Last year the company paid an $18.5 million fine to the New York attorney general’s office to settle a long running probe. NY attorney general Letitia James’ office at one time said “Bitfinex and Tether recklessly and unlawfully covered-up massive financial losses to keep their scheme going and protect their bottom lines,” before adding “Tether’s claims that its virtual currency was fully backed by U.S. dollars at all times was a lie.”

That’s not the sort of thing you want to read if you’re trading with USDT.

The biggest gaming news, reviews and hardware deals

Keep up to date with the most important stories and the best deals, as picked by the PC Gamer team.

For now, Tether appears to be able to weather these fluctuations and maintain its $1 peg, but if Tether were to collapse, crypto would be facing an apocalypse the likes of which it has never seen. As always, trade carefully and be aware of the risks!

Chris' gaming experiences go back to the mid-nineties when he conned his parents into buying an 'educational PC' that was conveniently overpowered to play Doom and Tie Fighter. He developed a love of extreme overclocking that destroyed his savings despite the cheaper hardware on offer via his job at a PC store. To afford more LN2 he began moonlighting as a reviewer for VR-Zone before jumping the fence to work for MSI Australia. Since then, he's gone back to journalism, enthusiastically reviewing the latest and greatest components for PC & Tech Authority, PC Powerplay and currently Australian Personal Computer magazine and PC Gamer. Chris still puts far too many hours into Borderlands 3, always striving to become a more efficient killer.